reverse tax calculator uk

The Tax Calculator uses tax information from the tax year 2022 2023 to show you take-home pay. This tells you your take-home pay if you do not have.

Ultimate Corporation Tax Calculator 2022

Due to rounding of the amount without sales tax it is possible that the method of reverse calculation charges does not give 001 to close the total of sales tax used in every businesses Calculators Canada sales tax GSTHST remittance calculator.

. How do I calculate VAT backwards in Excel. Amount with VAT UK VAT UK VAT UK Amount without TVA UK Formulas to calculate the United Kingdom VAT Here is how the total is calculated before VAT. This is based on Income Tax National Insurance.

Reverse Sales Tax Calculations. Amount with VAT 1 VAT rate 100 Amount without VAT. Contractor Tax Calculator Income Tax Calculator.

Use this service to estimate how much Income Tax and National Insurance you should pay for the current tax year 6 April 2022 to 5 April 2023. An accurate breakdown of your pay is provided by incorporating the calculations for the following common pay allowances and deductions. The reverse sales tax calculator exactly as you see it above is 100 free for you to use.

See where that hard-earned money goes - with UK income tax National Insurance student loan and pension deductions. Use the reverse vat calculator on this page to calculate the price less VAT. Click the Customize button above to learn more.

If you want to customize the colors size and more to better fit your site then pricing starts at just 2999 for a one time purchase. Yes simply divide your GROSS amount by 12. Reverse VAT calculator in UK for 2022 Free calculator of inverted taxes for United Kingdom Do you like Calcul Conversion.

This UK Tax Calculator will make light work of calculating the amount of take home pay you should have after all income tax deductions have been considered. Youll be able to see the gross salary taxable amount tax national insurance and student loan repayments on annual monthly weekly and daily bases. Amount with VAT UK VAT UK VAT UK Amount without TVA UK Formulas to calculate the United Kingdom VAT Here is how the total is calculated before VAT.

To add 20 VAT to 10000 simply multiply 10000 x 12 12000 But calculating what is the VAT portion of 12000 is not as simple as taking 20 of 12000 which leaves 9600. Calculator formula Here is how the total is calculated before sales tax. Adding 20 VAT is a straightforward calculation but reverse VAT can be tricky Adding 20 VAT to a price is easy simply multiply by 12 eg.

Our CIS Tax Deduction Calculator can assist contractors in calculating the correct deductions to make. For the reduced VAT rate of 5 divide the GROSS figure by 105. Reverse VAT calculator in UK for 2015 Free calculator of inverted taxes for United Kingdom Do you like Calcul Conversion.

All taxes ERs EEs Fees and Expenses. When youre done click on the Calculate button and the table on the right will display the information you requested from the tax calculator. Sales Tax Rate Sales Tax Percent 100.

Tax year. It will work for all types of subcontractors Gross 0 CIS Deduction Net 20 CIS Deduction and Unregistered 30 CIS Deduction. Payment for the supply is reported within the Construction Industry Scheme CIS the services you.

Reverse Tax Calculator Contractor Tax Calculator If you are a contractor working inside IR35 under an umbrella company you can use this calculator to accurately generate payslips and a pay summary for any contract from April 2009. Note that for UK income above 100000 the Personal Allowance reduces by 1 for every 2 of income. Your customer is registered for VAT in the UK.

It has also been updated for the VAT reverse charge requirements which apply from 1st March 2021. Where Sales Tax is the dollar amount of sales tax paid Sales Tax Percent is the state sales tax as a percentage and Sales Tax Rate is the state sales tax as a decimal for calculations. Our tax calculator calculates your personal tax free allowance.

This works for a 20 VAT rate. Contractor Tax Calculator Income Tax Calculator. Amount with sales tax 1 GST and QST rate combined100 or 114975 Amount without sales tax Amount without sales tax GST rate GST amount Amount without sales tax QST rate QST amount Margin of error for sales tax.

The reverse charge will need to be used when. Reverse Tax Calculator Contractor Tax Calculator If you are a contractor working inside IR35 under an umbrella company you can use this calculator to accurately generate payslips and a pay summary for any contract from April 2009. Amount with VAT 1 VAT rate 100 Amount without VAT.

Can I use a calculator to calculate reverse VAT. An error margin of 001 may appear in reverse calculator of Canada HST GST and PST sales tax. All taxes ERs EEs Fees and Expenses.

Price before Tax Total Price with Tax - Sales Tax. Personal Tax Free Allowance Table of personal tax free allowance by tax year. More information about the calculations performed is available on the about page.

Income Tax Formula Excel University

Austria Salary Calculator 2022 23

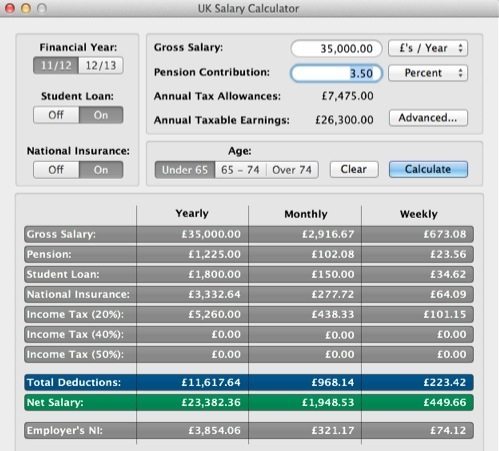

Uk Tax Calculators Apps On Google Play

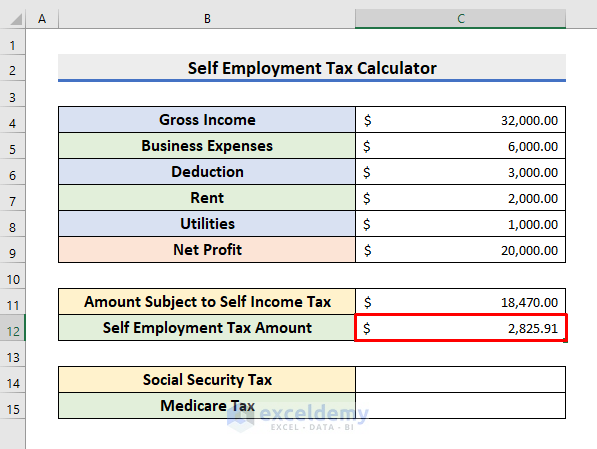

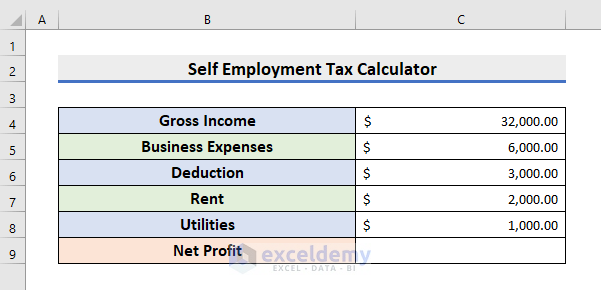

Self Employment Tax Calculator In Excel Spreadsheet Create With Easy Steps

Self Employment Tax Calculator In Excel Spreadsheet Create With Easy Steps

Uk Tax Calculators Apps On Google Play

Use This Sales Tax Calculator To Figure Sales Tax Or Vat Gst At A Rate Of 7 75 Free To Download And Print Tax Printables Sales Tax Tax

How Interest Rates Can Impact Your Monthly Housing Payments Mortgage Loans Mortgage Calculator Reverse Mortgage

Income Tax Formula Excel University

How To Calculate Vat In Excel Vat Formula Calculating Tax In Excel

Tip Sales Tax Calculator Salecalc Com

Uk Tax Calculators Amazon Com Appstore For Android

Six Apps To File Taxes On The Mac Chriswrites Com

How To Calculate Income Tax In Excel

How To Calculate Income Tax In Excel